A Complete Guide to Foreign ESOPs for Indian Employees

A Complete Guide to Foreign ESOPs for Indian Employees

Taxation, Compliance, and Reporting of Foreign ESOPs: A Guide for Indian Employees

- Last Updated

With globalization being at its peak, Employee Stock Ownership Plans (ESOPs) have now become a popular tool for rewarding and retaining talent, especially in multinational companies that operate across the world. While foreign ESOPs are employees’ opportunity to build wealth and a sense of ownership, there are also significant compliance obligations under Indian tax and regulatory frameworks.

The Income-tax department has launched a compliance awareness campaign for the year 2024, wherein the Income-tax department is sending reminders through advertisements in newspapers and emails to taxpayers identified as having foreign assets based on information shared by foreign tax jurisdiction. They are also collaborating with the HR teams of 42 multinational corporations (MNCs) to educate their employees in India about their obligations to disclose foreign ESOPs and other assets in the Income-tax returns (ITR).

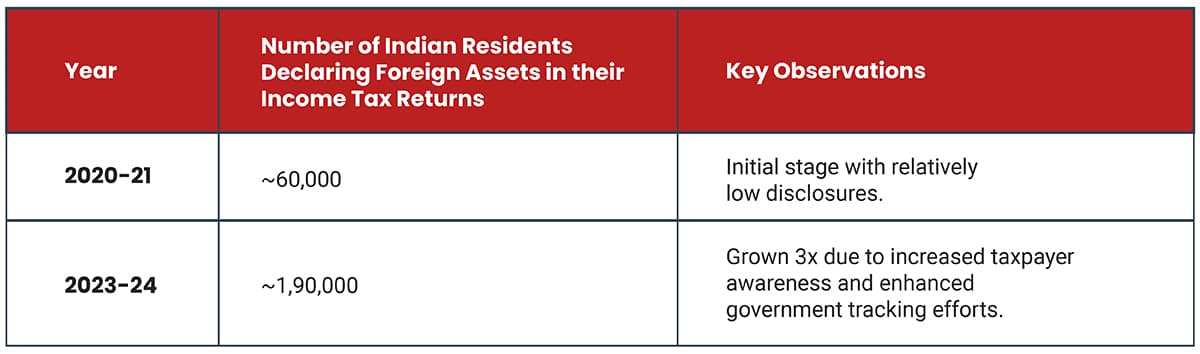

The trend of Indian residents disclosing foreign assets in their Income Tax Returns has significantly grown over the past few years. Here’s a snapshot of how this trend has evolved:

What are Foreign Assets?

Foreign assets refer to any property or financial assets that are owned by a person or entity outside the country of their residence. These assets can be in various forms, including

- Foreign bank accounts, depository accounts,

- Foreign investments (stocks, mutual funds, bonds),

- Foreign real estate (immovable property),

- Cash value insurance contracts or annuity contracts,

- Trusts outside India, in which the Indian taxpayer is a Trustee, beneficiary, or settlor.

- Foreign custodian account,

- Foreign ESOPs issued by foreign companies to Indian employees.

Who is required to report?

An Indian resident taxpayer must mandatorily fill the Schedule FA and Schedule FSI provided in the Income Tax Return (ITR) in ITR 2 and ITR 3 for reporting the above foreign assets including Foreign ESOP held/income earned by them during the financial year. This requirement is applicable to individuals who satisfy the “residential” criteria, not including non-residents and those classified as “Resident but Not Ordinarily Resident (RNOR).” Even if the income of Indian resident taxpayer is below the taxable limit, they need to file and disclose their foreign assets details in their return in form ITR 2 or ITR 3.

What is Foreign ESOP?

ESOPs issued by a foreign holding company to the employees of its Indian subsidiary are known as Foreign ESOPs for the Indian employee. They also fall in the category of foreign assets and need disclosure in their respective ITRs.

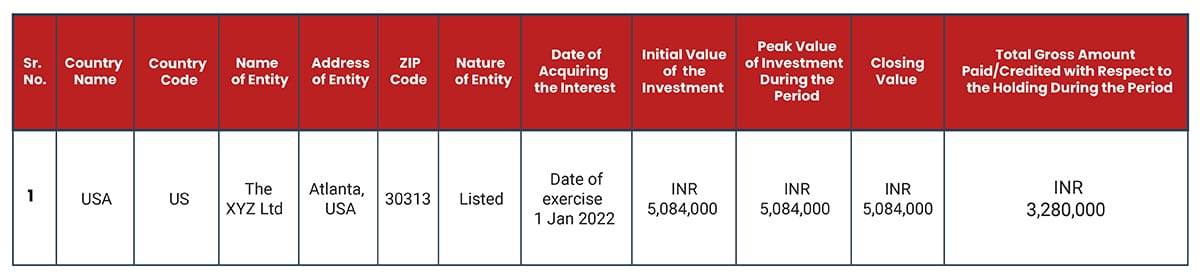

How are Foreign ESOP disclosed in the ITR 2 Schedule FA?

The below table elaborates how 1000 Foreign ESOP would be declared by Mr. A in the ITR 2, schedule FA.

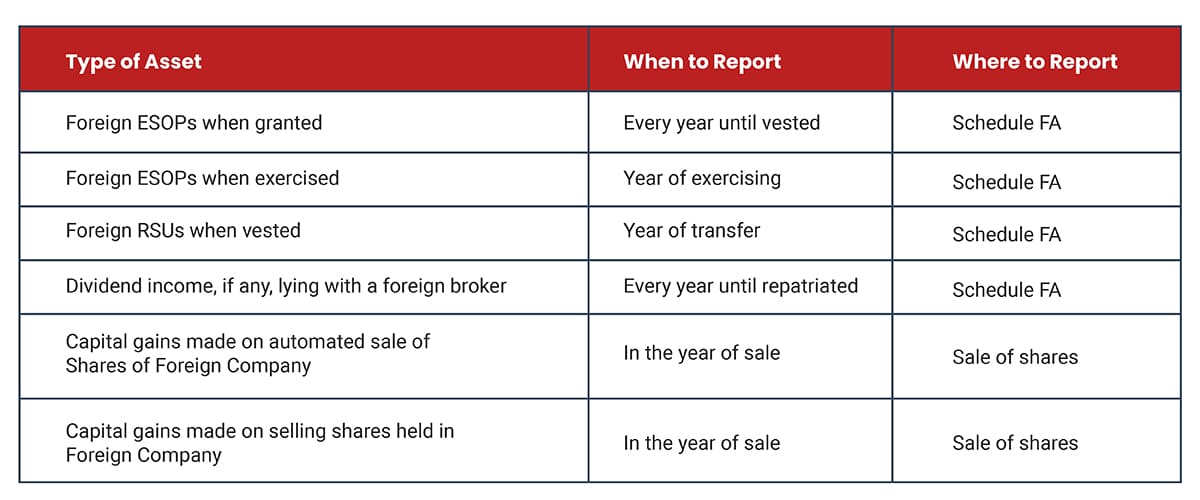

Timing of reporting Foreign ESOP’s/RSU’s held by employees

Timeline for reporting

Typically, the last date to file Income tax return (ITR) is 31st July for the preceding financial year. And those tax filers who fail to file their income tax returns by 31st July are permitted to file their tax return three months before the end of the Assessment Year (A.Y.) i.e., by 31st December.

Extension Alert: The Central Board of Direct Taxes (CBDT) vide circular no. 21 of 2024 dated 31st December 2024, has extended the due date for filing belated or revised returns for the A.Y. 2024-25 to 15th January 2025. This gives taxpayers additional time to rectify errors or omissions, including the disclosure of foreign ESOPs by 15th January 2025.

However, taxpayers must pay a small fee when they file a belated tax return. For a gross income up to INR 5 lakh, the late filing fee is INR 1,000 and for a gross income of more than INR 5 lakh, the late filing fee is INR 5,000.

Accordingly, an employee has already filed their ITR and missed disclosing their foreign ESOPs, the return can be revised before 15th January 2025. If the return is updated before the tax department issues a notice, all penal consequences shall be waived off, including the penalty for non-disclosure under Black Money (undisclosed foreign income and assets) and Imposition of Tax Act, 2015 (Black Money Act 2015) should be waived off.

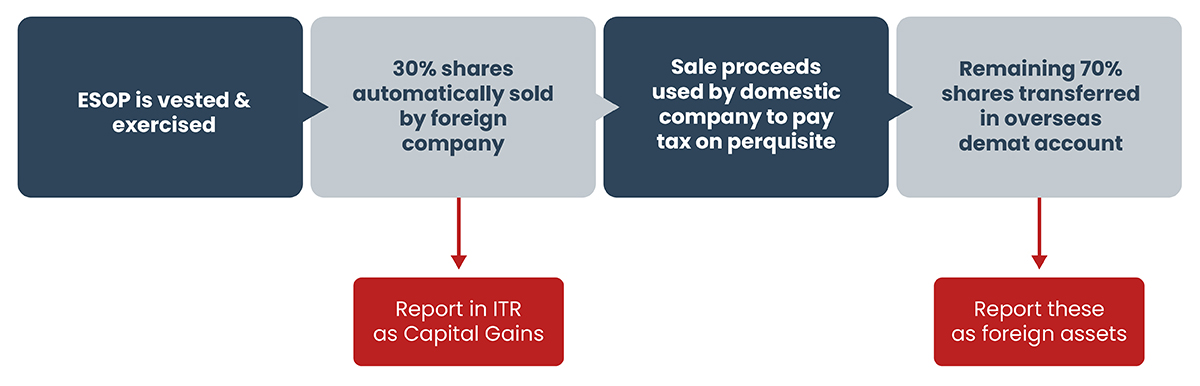

How will ESOP’s reporting work?

Myths around disclosure of Foreign Assets

- “Employers are solely responsible for declaring and paying taxes on income from ESOPs.”

While employers deduct tax at source on income from ESOPs, it is the employee’s primary responsibility to declare this income in their Income Tax Return (ITR) and ensure all taxes are paid on time. Employees must also claim tax credits for any taxes paid or deducted outside India on foreign ESOPs. Such tax credits can be availed under the Double Taxation Avoidance Agreement (DTAA) between India and the respective country. - “Only Indian taxpayers with income exceeding INR 50 lakhs need to disclose their foreign assets and liabilities.”

The taxpayers with total income exceeding INR 50 Lakhs must disclose their assets and liabilities. Although, the taxpayers holding foreign assets, like foreign ESOPs are an exception. Irrespective of their total income, disclosure of foreign assets in the FA Schedule of the ITR is compulsory. Hence, compliance with regulations for reporting foreign assets and liabilities should be complied with, even if taxpayer’s total income is below the INR 50 lakh limit.

What happens in the case of non-disclosure by an individual holding Foreign ESOP/assets?

Disclosing foreign assets accurately in Schedule FA is mandatory. Failing to do so can lead to severe consequences, including:

- As per the Black Money Act, 2015, failing to disclose foreign assets including Foreign ESOP, or inaccurate disclosure of foreign assets in relevant ITR attracts a penalty of INR 10 lakhs without considering the value of assets located outside India.

- Further, in addition to the above penalty, prosecution may be initiated under Black Money Act, 2015 on such person with a punishment of rigorous imprisonment for a term which shall not be less than 6 months, but which may be extended to 7 years.

- Double Taxation Avoidance Agreements (DTAAs) help avoid paying taxes on the same income in two countries. Failure to disclose foreign assets, leads to loss of the right to claim relief under any applicable DTAA, potentially leading to double taxation on one’s foreign income.

Conclusion

The Central Board of Direct Taxes has stressed importance of correctly reporting foreign assets (including Foreign ESOPs for Indian employees) in the ITR-2 form to avoid penalties. The Income-tax department permits taxpayers to correct any omissions or inaccuracies by filing a revised return. For A.Y. 2024-25, the deadline for filing a revised return is 15th January 2025. Disclosure of foreign assets including Foreign ESOPs and income in ITR is a critical requirement to ensure transparency in tax compliance and avoid penalties. Getting tax relief for taxes paid outside India is easier with accurate filling of schedules for foreign assets and income in order to avoid heavy penalties, Indian employees receiving foreign ESOPs have time for revising or updating their ITR for the AY 2024-25 on or before 15th January 2025. Failure to disclose or incorrect disclosure may lead to penalties up to INR 10 lakhs.

Why Choose InCorp?

We, at InCorp will assist you in the following services:

- Assistance in structuring of ESOP as per the requirement

- Providing advisory services on regulation and taxation to ensure accurate compliance and optimal structuring

- Assistance in preparation of necessary documentation and administration required for Foreign ESOP

To learn more about our Taxation and Advisory services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Megha Gala| Taxation and Advisory

FAQs:

Yes, although the Foreign ESOPs were acquired when the individual was a non-resident, the individual must disclose these assets under Schedule FA (Foreign Assets) in their Income Tax Return as soon as they become a resident and ordinarily resident in India.

Yes, all employees are required to disclose foreign assets, including received during previous employment. Such disclosure is mandatory, regardless of the individual’s current employment status.

Yes, an employee in India may file a revised return at any time on or before 15 January 2025, for the A.Y. 2024-25 as per CBDT circular no.21 of 2024 dated 31 December 2024. In such a revised return, the employees in India may comply with the Foreign ESOP’s/Assets disclosure reporting requirements.

. As per provisions of Section 42/43 of the Black Money Act, failure to disclose or file return of income despite holding foreign assets or failure to disclose such foreign assets is liable to a penalty of INR 10 Lakh.

No, there is no time limit to issue a notice under the Black Money Act, unlike the Income-tax Act, 1961 where the time limit is 3 years to reopen the assessment (6/10 years in certain cases).

Share

Share