How Restructuring Shapes Business Growth

How Restructuring Shapes Business Growth

Strategic overhaul: Corporate restructuring pathways to align long-term goals, address financial challenges, and enhance competitiveness.

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

Corporate restructuring can be an effective strategy used by a business to improve its capital structure or operations in a significant manner. This strategy is implemented in situations where a corporate entity is in a turbulent situation and comes out of financial jeopardy. Many companies undergo corporate restructuring to improve their capital structure or operations. This helps them reduce costs, improve efficiency, and boost profitability. To ensure a successful business restructuring, it is pertinent to understand the company’s overall value. There are two fundamental ways that a business endeavors to meet its long-term business objectives, i.e. organic growth (e.g., product development, internal expansion) and inorganic growth (which often involves corporate restructuring). Corporate restructuring is an indispensable strategic tool used to improve the efficiency and effectiveness of a business and its operations. Corporate restructuring is pursued to move closer towards the long-term corporate objectives of a business in an inorganic way.

At its core, the primary objective of any business from corporate restructuring is to create wealth for its investors and to make a positive impact in the community in which the business operates. Therefore, in an ever-changing marketplace, corporate restructuring becomes an essential strategic tool in achievement of the objectives of value creation and sustainable growth. In this blog, we shall further look at the key components and the factors that drive the businesses to undertake such strategic initiatives.

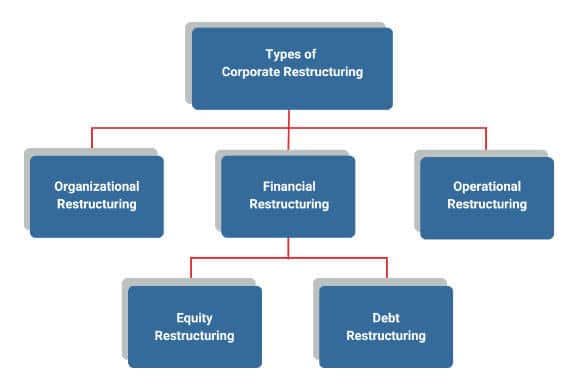

Types of Corporate Restructuring

1. Financial Restructuring

Financial restructuring is used as a tool in optimizing the financial health of an organization by optimizing the capital structure, or improving liquidity, etc.

Mentioned below are the two modes of corporate restructuring

i. Equity Restructuring

The employment of this method can be seen in optimizing the ownership structure. This is made possible with the help of the issue of new shares, buying back of shares, debt-to-equity swaps, equity carve-outs (divestiture of a subsidiary or business unit through a spin-off or an IPO), etc.

ii Debt Restructuring

This method calls for renegotiation of the terms of debt with the creditors and changing the terms of such debts. Such renegotiation and modification may be with respect to the changes to the interest rates, changes to the tenure of loans, etc., with the primary objective of providing relief to a financially distressed organization. In certain cases, the creditors may even agree to convert a part of the debt or the whole of the debt to equity. This ensures the organization functions as a going concern during the times of financial distress.

2. Organizational Restructuring

This method of corporate restructuring aims to change and improve the organizational structure for better communication and decision-making. This can be achieved by changes to the hierarchy. This may either include flattening the management structure or increasing the levels of management, creating a required hierarchy, which results in improved agility and responsiveness in an organization.

3. Operational Restructuring

Companies sometimes reconsider the manner of carrying out their day-to-day business to stay in the race of the dynamic business world. This is possible by using operational restructuring as a strategy for streamlining workflow and optimizing financial resources. Here are some other common ways to achieve this:

i. Downsizing

A company might go for reducing its workforce or outsource certain internal functions. This helps the business in the enhancement of its efficiency in a significant way and saves on its costs associated with staffing.

ii. Mergers & Acquisitions (M&A)

Companies collaborate with an intent to share the resources, reach out to new customers, and make optimum use of their combined size.

4. Divestiture

Selling off parts of a business that is not of great importance to the company or does not add any substantial value to the company’s growth. Further, this helps a company focus on what it does best and increase its profits. Additionally, divestiture gives a considerable cash flow to the company. Also, divestiture can create an effect of reverse synergy where the value of an individual entity may be more than the merged one.

5. Process Improvement

Introducing new technology, task automation, and redesigning the workflow benefits a company by decreasing waste and saving time, which can be diversified to other tasks.

In a nutshell, corporate restructuring is all about figuring out ways to do things in an efficient manner ensuring companies maintain their relevance and remain successful in today’s fast-paced and dynamic business environment.

Need for Corporate Restructuring

1. Economies of Scale and Vertical Integration

Corporate restructuring can be used for both economies of scale and vertical integration. Economies of scale arise from reducing the cost of capital by increasing production volume by allowing the businesses to spread their fixed costs over a greater number of units, which consequently leads to higher profit margins and improved shareholder confidence. The economies of vertical integration are when the businesses own parts of the supply chain, which reduces dependency on suppliers and enhances control over the production and the quality which offers a competitive edge. Both strategies streamline operations and increase profitability.

2. Risk Reduction

Corporate restructuring allows businesses to explore newer markets, strengthen their supply chains, diversify operations, etc. This is achieved through divestiture of underperforming wings of the business and acquisition of businesses. This ensures optimal utilization of an organization’s resources and fosters long-term sustainable growth of a business, along with enhanced shareholders’ confidence.

3. Utilization of Surplus Funds

When a business has surplus funds and no good opportunities to invest internally in its business, it is imperative to invest in companies with a significant potential for long-term growth and to meet the long-term objectives of the organization.

4. Solvency Issues

The business, at times, has low profitability which possibly threatens its solvency position and its long-term survival. Corporate restructuring offers targeted solutions to reverse the underlying issue of low profitability, high levels of debt-equity ratio, inefficient use of assets, etc. It might involve streamlining operations to reduce costs, divestiture of unprofitable divisions to focus on profitable divisions, or merging with or acquiring other businesses to gain an increased market share and improve efficiency. These steps help in improving profitability and fix the solvency position of a company.

5. Tax Benefits

In India, businesses are allowed to take an advantage of the use of the tax benefits that are related to Mergers and Acquisitions (M&A). Additionally, exemptions on capital gains taxes for specific kinds of share transfers offer financial relief for participating companies.

Section 72A of the Income Tax act of 1961 permits the accumulated loss and unabsorbed depreciation of the amalgamating company to be carried forward. By strategically taking advantage of these taxation benefits, companies can maximize the value of their M&A transactions, driving profitability, growth, and financial efficiency while lowering their tax burden.

Conclusion

In conclusion, corporate restructuring aids businesses to navigate through an ever-evolving market landscape and optimizes the operations of a company for long-term success. Through financial, operational, or organizational restructuring, corporates aim to minimize their cost of capital and improve overall performance. By embracing change and business process reeingineering, businesses can now tap into the new growth horizons, increase shareholder value, and ultimately secure their position as leaders in their respective industries.

Effective corporate restructuring requires meticulous planning, execution of strategy, and a keen understanding of the company’s unique challenges and objectives. By considering the various strategies outlined in this article, businesses can now make a reasoned decision that sets their companies on a path towards long-term sustainable growth and resilience in an increasingly competitive marketplace.

Why Chose InCorp

At InCorp, we understand the complexities and the importance of corporate restructuring. And such complexities call for a specialized service with the help of our experienced professionals at InCorp. Our team of experts conduct a 360-degree assessment to identify the needs of your business. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Frequently Asked Questions

Corporate restructuring involves reorganizing a company’s structure, operations, or finances to improve efficiency, competitiveness, and long-term sustainability.

It enables businesses to focus on core operations, unlock new revenue streams, and optimize resources, fostering growth and expansion.

Key types include financial restructuring, operational restructuring, mergers and acquisitions, divestitures, and debt restructuring.

Restructuring can reduce debt, improve liquidity, enhance profitability, and strengthen the balance sheet, supporting financial stability.

It helps eliminate inefficiencies, streamline operations, and optimize resource allocation, leading to significant cost savings.

Share

Share