Navigating Real Estate Insolvency: Challenges and Strategies for Resolution Plans

Navigating Real Estate Insolvency: Challenges and Strategies for Resolution Plans

Decoding Resolution Plans: An In-depth Analysis

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

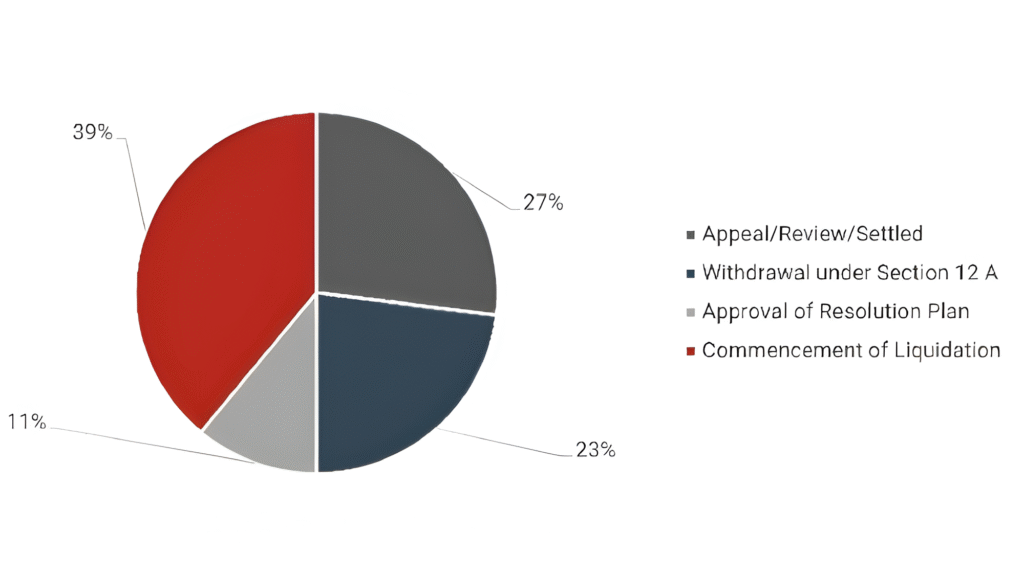

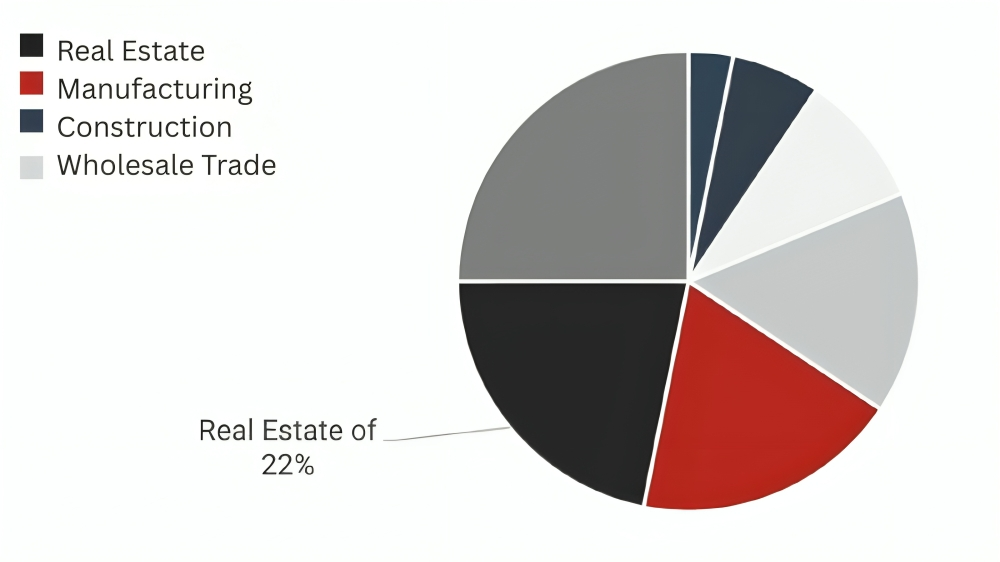

Insolvency Professionals are the lifeline in the chaotic corporate insolvency situations especially in real estate. As per the recent statistics from September 2024 by Insolvency and Bankruptcy Board of India (“IBBI”), 8002 cases are admitted for CIRP under the Insolvency and Bankruptcy Code, 2016 (“Code”), out of which 1746 cases which is about 22% are from real estate sector. Out of these 1746 cases, 1237 cases are concluded, but only 165 cases are resolved. So the success rate in real estate insolvency is 13%. Further 509 cases from the real estate sector are active, which means the complexity is high in these situations.

Here are the reasons why resolutions are not being achieved:

- Distressed projects: Most distressed projects are in losses, so there’s no commercial motivation for buyers to invest. And one of the biggest challenges for the Resolution Applicants is to provide units to the homebuyers at the same rate agreed upon between the company and the homebuyers even if the construction cost is increasing which discourages them from submitting a resolution plan.

- Information Asymmetry: Most Homebuyers are not aware of the Code and cannot submit their claims on time. Lack of information hinders CIRP, defeats the “time bound” objective of the Code and increases CIRP cost.

- Judicial Timelines: Delays in pre-admission and post-approval stages have resulted in decrease in asset value and suboptimal recoveries for Resolution Applicants.

The legal and technical complexities of Corporate Insolvency Resolution Process (CIRP) in real estate can be tough to navigate. Also managing the homebuyers who are impacted by CIRP is a challenge. The RP has to manage the emotions of the homebuyers who have invested their long term savings and are now uncertain due to CIRP. Uncertainty and ambiguity around asset ownership is the biggest challenge in most cases. Add to this the fluctuating market value and it’s a big challenge. The viability of the resolution plans gets impacted negatively by these and ultimately affects the recoveries of the creditors.

One of the CIRP is due diligence which includes a thorough analysis of the corporate debtor’s financial statements and operational capabilities to identify the challenges and risks. The Resolution Professional (RP) has to do due diligence of the resolution plan and ensure that the resolution plans are not only regulatory compliant but also address the financial distress of the corporate debtor and maximize the value of its assets and ensure a fair and transparent process. So due diligence is necessary for an effective and fair resolution.

In the complex CIRP world RPs have many responsibilities. These responsibilities not only include managing the legal complexities with technical expertise but also strategic acumen to manage the process as smoothly as possible.

The RP must comply with the Code and the rules and regulations made thereunder. The RP has a crucial role to play in the corporate insolvency resolution process in the following areas:

1. Transparency: Disclosures in Information Memorandum

The IRP/RP must have all facts about the CD and put them in the Information Memorandum (IM). The sources of such facts must be cited in the IM and the elements that could change must be clarified. If the IM is not comprehensive, the RP must issue the IM to the best of his/her ability. The RP must disclose all material information about the CD to the Prospective Resolution Applicants (PRAs) as soon as he/she comes to know.

2. Fairness and Inclusivity: Verification of Claims

Regulation 13 and 14 of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 (“CIRP Regulation”) requires RP to verify every claim as on the Insolvency Commencement Date. Also, RP has to maintain a list of creditors containing names of creditors along with the amount claimed by them, amount of their claims admitted and security interest if any, in respect of such claims and update it. Clearly RP has a big role to play in verification of claims.

Since RP has a big role to play in verification of claims, RP should not reject the claims submitted to RP only because the claim submitted is not in the form as specified in the said regulations. Forms in the Code and the regulations made thereunder are directory, not mandatory. The critical thing is that each claim should be supported by sufficient evidence. RP should go through the books of account and other records of the Corporate Debtor and try to reach out to the creditors to submit the claim. If claims are not received, details of such creditors along with their debt amount should be mentioned in the Information Memorandum.

RP should ensure that all genuine claims have been admitted and mentioned in the IM and Prospective Resolution Applicants are informed of the same. This will reduce litigation post approval of the resolution plan by the Committee of Creditors.

3. Contingencies: Assets Not Forming Part of assets of the Corporate Debtor

The RP often encounters significant challenges with respect to the determination of the ownership of the assets of the corporate debtor. Further, in accordance with Section 25 of the Code, the RP shall take the custody and control of all the assets of the Corporate Debtor. The RP must clarify ownership of the assets of the Corporate Debtor in the Information Memorandum, this calls for a thorough evaluation of the properties owned by the CD. For the Corporate Insolvency Resolution Process to result in successful resolution of the corporate Debtor, preparation of a correct information memorandum is a must, which may result in viable resolution plans.

The RP is also responsible to collate information relating to the ongoing litigations involving the assets of the Corporate Debtor and address all the disputes over rights in relation to the property of the Corporate Debtor. The said information/documents may be collected from the erstwhile Legal Counsel of the Corporate Debtor. Furthermore, the RP shall balance various interests of the stakeholder, including those without formal legal claims.

4. Balancing Act: Lenders vs. Homebuyers

Homebuyers interest differs from the lenders interest who are the financial institutions. Homebuyers want to take possession of the properties, lenders want to recover their loan. Homebuyers interest gets compromised as they hold a minority stake in the CoC against the majority control of the creditors in the CoC. RP shall ensure that there is a balance between the two and the key challenges in balancing are as follows:

Related Read: Fast Track Insolvency Resolution: A Quick Overview

Stakeholder Dynamics and Evaluation Matrix: The primary tool to balance the interest in CIRP is the evaluation matrix which is used as a mechanism in the assessment of the resolution plans. RP must ensure that the parameters in the evaluation matrix are beneficial to all the stakeholders and can be done by acting as a mediator between the financial creditors and the real estate allottees. While real estate allottees want to take possession of their assigned units, financial creditors want to recover their debts and prefer resolution plans that give substantial cash recovery. RP should align these conflicting priorities by modifying the evaluation matrix which involves negotiations to reach a common ground for all.

Challenges Beyond Negotiation: Funding and Operations: RP faces the challenge of raising interim finance from the CoC. Real estate allottees find it difficult to contribute to the costs as they are cash strapped and financial creditors are generally not willing to provide interim finance for the entire process. So RP must work closely with the CoC to devise a viable interim finance strategy and ensure effective management of the corporate debtor’s ongoing operations to keep the insolvency resolution process on track.

Conclusion

A Resolution Professional in CIRP is the key. The RP has to navigate these legal frameworks, technical details and conflicting stakeholder interests. Resolution Professionals play a critical role in managing distressed real estate companies through legal, technical and emotional complexities to get fair and equitable outcomes for all stakeholders including creditors, statutory authorities, investors and homebuyers. The RP has to recognize the special position of homebuyers and assure them that the insolvency resolution process is fair and follows the legal framework to protect all stakeholders’ interests. This is achieved by being transparent, providing updates and allowing homebuyers to have a voice in the decision making.

To address the homebuyers’ concerns two options can be considered, Reverse CIRP and Project Wise CIRP. These CIRP processes are not codified, various judgments have allowed these options given the complexities in the real estate sector. Reverse CIRP and Project-Wise CIRP are judicially evolved concepts, first applied in the insolvency resolution process of Umang Realtech Private Limited (Flat Buyers Association Winter Hills vs. Umang Realtech Pvt. Ltd.). These concepts solve the challenges in the insolvency resolution process, especially for homebuyers. Recognition of these concepts in the Code and its regulations will further solve these challenges.

Another challenge in CIRP in the real estate sector arises when part of the corporate debtor’s project is completed. Homebuyers of the completed portion often do not understand the legal intricacies of the insolvency process. Co-ordination with these homebuyers becomes essential to maintain a smooth environment which in turn gives confidence to other investors that they will cooperate. The Resolution Professional has to be nimble to adapt to changing regulatory landscape to ensure CIRP is fair, transparent and balanced with consideration of all stakeholders.

InCorp has been dealing with these complexities for years and provides customized solutions to Resolution Professionals, Creditors, Corporate Debtors, Suspended Boards of Directors and other stakeholders. Our team of professionals combine financial and legal expertise with strategic understanding. We adhere to the highest professional standards and ethics.

FAQ

The RP must diligently verify all claims submitted by creditors, regardless of the form in which they are filed. The forms provided in the Code are directory and not mandatory.

Yes, the Evaluation Matrix can be modified only once. Any modification in the evaluation matrix shall be deemed to be a fresh issue and a fresh 30-day period will be provided to the Prospective Resolution Applicants to submit their resolution plans.

Authored by:

Rashmi Jadhav | IBC

Share

Share