Revised Angel Tax Valuation Rules: Key Updates

Revised Angel Tax Valuation Rules: Key Updates

New Angel Tax valuation rules: Exemptions, FMV methods, and safe harbor limits for startup investments

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

The Central Board of Direct Taxes (CBDT) has issued a notification* that amends Rule 11UA of the Income-tax Rules, 1962 (the Rules). This notification outlines the valuation methods to be used for establishing the fair market value of investments in shares by resident and non-resident investors in closely held companies (CHCs) (like ‘start-ups’). This method will be employed to determine the FMV for the purpose of applicability of ‘angel tax’ to CHCs/start-ups.

* Notification no.81/2023 dated 25 September 2023

Background

a. Angel tax, encompasses the taxation of excessive premiums received by CHCs from both residents and non-residents, starting from the financial year 2013-14 at a price that exceeds the fair market value (FMV) of their unquoted equity shares/CCPS.

b. While the previous version of the Rule offered only two approaches for establishing the FMV i.e. (i) the Discounted Cash Flow (DCF) method and (ii) the Net Asset Value (NAV) method. The updated Rule has retained these two methods while introducing five new valuation methods and benchmarks for share valuation.

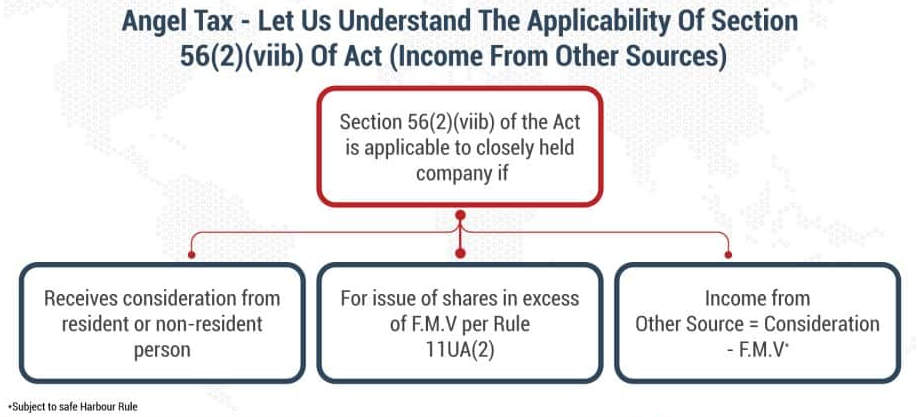

Angel Tax – Let us understand the applicability of section 56(2)(viib) of Act (Income from Other Sources)

Exemption from Angel tax

The following companies are exempted from the applicability of Angel tax :

i. Company receives consideration from a Venture Capital Company or a Venture Capital Fund or any specified fund; or

Related Read: Guide to ISD and Cross Charge under GST

ii A Start-up

– Recognized by Department for Promotion of Industry and Internal Trade (DPIIT) and

– The aggregate amount of paid-up share capital and share premium of the startup after the issue or proposed issue of shares should be less than INR 25 crores or

iii. The CBDT vide notification 29 of 2023 dated 24 May 2023, has notified these companies i.e., government, government-related investors, sovereign wealth funds, banks, FPI, regulated entities involved in insurance, etc. Additionally, investors from 21 countries, including the US, UK, and France, have been granted an exemption from angel tax. However, investments from countries such as Singapore, Netherlands, and Mauritius are not included in this list.

Valuation method for determining FMV as per Rule 11UA of the Act.

The methods used to ascertain the FMV of unquoted equity shares and compulsorily convertible preference shares (CCPS) including new International Pricing methods are as follows:

| Sr. No. | Method for valuation | Description | Ideal for which type of company |

|---|---|---|---|

| (i) | The Net Asset Value (NAV) (Merchant Banker / Chartered Accountant) | · Utilization of the company’s balance sheet to determine the fair market value of the shares by subtracting the company’s liabilities from its assets. | Asset Intensive companies, Mutual Fund, Exchange Traded Funds, REIT, Venture Capital Funds, etc. |

| (ii) | The Discounted Cash Flow (DCF) (Merchant Banker) | · Method that assesses the worth of an investment by considering its anticipated future cash flows. | Companies with positive cashflows from regular activities, Consulting Firms, Financial Service Firms, etc |

| Five new International Pricing methods (valuation by merchant banker) | |||

| (iii) | The Comparable Company Multiple Method (CCMM) | · This method uses market multiples of similar publicly traded companies to value the company’s share. (note 1) | Companies trading with diverse product or service portfolios, Corporate Finance departments, companies going for IPO, etc |

| (iv) | The Probability Weighted Expected Return Method (PWERM) | · FMV is estimated by taking into account the likelihood of various potential future scenarios.

· The company’s worth is equivalent to the present value of its anticipated future cash flows, with each outcome’s weight determined by its probability. |

Contract bidding companies, M&A advisory firm, Investment Bank, etc |

| (v) | The Option Pricing Method (OPM) | · Share’s value is equivalent to the present value of its anticipated future cash flows, augmented by the value of the option to buy or sell the share at any given point in time. | Asset-lite companies like Startups or Capital deficient companies, Companies with complex capital structures, etc. |

| (vi) | The Milestone Analysis Method (MAM) | · This method centers around pinpointing key milestones outlined in a company’s business plan or development roadmap. These milestones may encompass product launches, user acquisition targets, revenue objectives, or other significant accomplishments.

· With each milestone achieved, the company’s risk decreases, leading to an increase in the company’s value. |

Companies with limited operating history, Software development companies, R&D companies which that aims to commercialise the product/services post development, Construction companies, event management companies, companies with forward and backword integration, etc |

| (vii) | The Replacement Cost Method (RCM) | · This method operates on the assumption that a buyer would not pay more for a company than what it would cost to replace it with a similar one. | Heavy Asset intensive firms, distressed entities, manufacturing company with heavy asset base, M&A within group/associate companies, competitive synergy of companies, etc |

Note 1 – Selecting comparable companies is challenging because finding exact matches in terms of product/service mix, size, business strategy, geography, and lifecycle stage is rare.

Note 2 – Replacement cost does not necessarily reflect the true economic value of an asset to a buyer. The FMV considers factors beyond just the cost of replacement, such as market demand, location, condition, and other qualitative aspects.

Applicability of valuation method for FMV

| Method | Safe Harbour | Investment received from | |||

|---|---|---|---|---|---|

| Resident | Non-Resident | ||||

| Equity Shares | CCPS | Equity Shares | CCPS | ||

| NAV | 10% upside | yes | Yes | – | – |

| DCF by Merchant Banker | 10% upside | yes | Yes | yes | yes |

| Price offered to Venture capital (issued to other investors)* | — | yes | Yes | yes | yes |

| International Pricing method by Merchant Banker (CCMM, PWERM, OPM, MAM & RCM) | 10% upside | – | – | yes | yes |

| Price offered to notified entities under Angel tax* | — | yes | Yes | yes | yes |

*if consideration is received within a period of 90days before or after date of issue of shares subject matter of valuation

Safe Harbour limit of 10%

Related Read: Strategic Moves for IPO-Bound SMEs

Rule 11UA(4) establishes a safe harbour threshold of 10% for the issuance of unquoted equity shares or CCPS. In practical terms, this means that if the issuance price of shares is slightly higher than the value determined according to Rule 11UA, as long as the difference does not exceed 10%, the issuance price will be considered as the FMV.

For instance, in respect of unquoted equity shares if the FMV is Rs 2000, shares are issued at Rs. 2,100 per share, then angel tax will not be imposed as the difference does not exceed 10% of FMV. However, it’s important to note that the safe harbour limit won’t be applicable if the FMV of shares issued to entities such as VC Funds, VC Companies, Specified Funds, or Notified Entities is considered a benchmark.

Window of 90 days period for merchant banker valuation

Under the previous Rule 11UA, a merchant banker’s valuation report was mandated to be prepared as of the date of the share issuance. However, the amended rule allows for the acceptance of valuation reports issued up to 90 days before the date of equity shares and CCPS issuance. This provision applies to the computation of FMV for investments by both resident and non-resident investors.

latest_post_from_category

Benchmarking with shares issued to VC Fund or VC Co. or Specified Fund

The provision states that if a Venture Capital Undertaking receives consideration for issuing shares to a Venture Capital Fund, Venture Capital Company, or a Specified Fund (Category I or II AIF), then the equity share price associated with that consideration can serve as the FMV for the shares issued to other investors if receipt of consideration is within a period of 90 days before or after date of issuance of shares subject matter of valuation.

Points for pondering

i. Securing Funds from a parent company or the same management companies does not eligibility criteria for Angel tax relief.

ii. Reports for claiming exemptions are valid for only 90 days, which is a short period in a practical sense.

Conclusion

Recent amendments to India’s valuation rules promise to boost the startup ecosystem. These changes offer flexibility, clarity, and transparency in assessing Fair Market Value for unquoted equity shares. They also establish a clear taxation framework, benefiting both local and foreign investors, and aim to reduce disputes arising from overvaluation. These measures are expected to promote growth and stability in the Indian startup ecosystem. The amended valuation is applicable prospectively from 25 September 2023.

Why Choose InCorp Global?

Authored by:

Megha Gala | Indirect Tax

FAQs

The rules define the method to calculate fair market value (FMV) for startup shares, aligning it with realistic pricing and reducing arbitrary valuations.

Startups must adhere to FMV calculations; overvaluation can attract angel tax, making funding more transparent and predictable.

Methods include Discounted Cash Flow (DCF), Net Asset Value (NAV), and Price of Recent Funding Rounds, depending on the stage of the startup.

Startups should maintain proper documentation, follow prescribed valuation methods, and file accurate declarations with the tax authorities.

Yes, startups meeting specified turnover limits or recognized under DPIIT may qualify for safe harbor provisions on valuation.

Share

Share