How Section 194T Impacts Partner Payments

How Section 194T Impacts Partner Payments

Navigating TDS Under Section 194T: What Partnership Firms & LLPs Need to Know

- Last Updated

Payments made by a partnership firm or LLP to its partners were not subject to TDS. The tax deduction at source (TDS) was applicable only in cases where payments were made to employees of a firm. However, the Finance Act, 2024 has introduced Section 194T, to include certain payments made to partners under the scope of TDS with effect from 1st April 2025.

This new provision applies to specific payments made by a firm to its partners, ensuring better tax compliance and streamlining tax collection at the firm level.

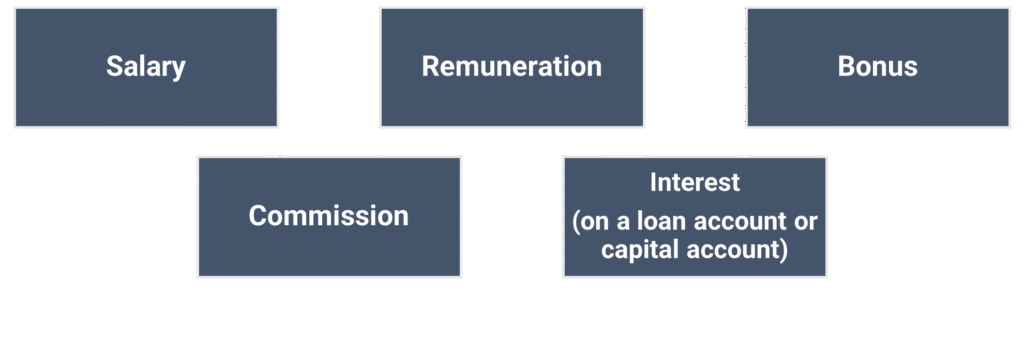

Payments Covered Under Section 194T

The following payments made by a firm to its partners are subject to TDS:

Definition

a. Firm: “Firm” shall have the same meaning as defined in the Indian Partnership Act, 1932 and the Limited Liability Partnership Act, 2008. ‘Firm’ shall cover traditional partnership firms as well as LLPs

b. Partner: The term “partner” shall have the meaning assigned to it in the Indian Partnership Act, 1932 (9 of 1932) and shall include—

• any person who, being a minor, has been admitted to the benefits of partnership; and

• a partner of a limited liability partnership as defined in the Limited Liability Partnership Act, 2008 (6 of 2009).

TDS Rate and Threshold

• TDS Rate: 10%

• Threshold Limit: TDS will be deducted only if the aggregate payments to a partner exceed ₹20,000 in a financial year.

When is TDS Deducted?

TDS u/s 194T must be deducted at the earlier of the following events:

• When the sum is credited to the partner’s account in the books of the firm (Accrual) or

• When actual payment is made to the partner (Payment).

Illustration

| Partner | Mr. X | Mr. Y | Mr. Z |

|---|---|---|---|

| Salary | 12,000 | 10,000 | 25,000 |

| Commission | 3,000 | 5,000 | 10,000 |

| Interest on Capital | 5,000 | 2,000 | 8,000 |

| Total payment | 20,000 | 17,000 | 43,000 |

| TDS Applicable? | No | No (Below ₹20,000 threshold) | Yes |

| TDS Amount (@ 10%) | N/A | N/A | 4,300 |

Compliances

a. Partner: File ITR on or before due date.

b. Firm: File quarterly TDS return by end of the month following the quarter end (For example: Tax Deducted at Source return for April to June to be filed by 31st July).

Non-Compliances

a. Interest and Late fees:

| Particulars | Amount / Rate |

|---|---|

| Non-deposit of TDS | 1.5% per month or part of the month |

| Non-deduction of TDS | 1% per month or part of the month |

| Late fees for TDS return | Rs. 200 per day from due date to furnish return (Subject to total amount of TDS) |

b. Section 40(a) disallowance: Section 40 only covers disallowance of deduction claimed from Section 30 to 38 of Income Tax act and since remuneration / bonus /commission to partners is covered u/s 40(b), no disallowance u/s 40(a) shall be made if TDS is defaulted on payment of remuneration / bonus / commission to partners.

c. Assessee in default: If the firm, defaults in deduction and deposit of Tax Deducted at Source for payments to partners, he shall be deemed to be Assessee in default u/s 201 and shall be liable for interest and penalties.

d. Tax audit: No adverse remarks in Clause 21(b) and Clause 34 in Form 3CD.

Practical Implications

A) Impact on Partner Withdrawals

- Many partnership firms, especially family-owned ones, follow ad-hoc withdrawal patterns based on cash flow needs.

- After 1st April 2025, TDS will have to be deducted on the payments and partners will need to plan and structure their withdrawals to manage Tax Deducted at Source deductions efficiently.

Related Read: Finance Act 2024: Key Changes in Reopening Tax Cases

B) Tax Planning Considerations

- Firms will have to account for TDS implications when making payments to partners, affecting tax planning and cash flow management.

C) Year-End Profit Allocation Challenges

- In firms where partners remuneration depends on profitability, the final amount is usually determined at the end of the financial year.

- To comply with TDS deposit deadlines (especially March quarter TDS due by April 30), firms may need to close their books earlier than usual.

Note: There is ambiguity for TDS Compliance, in a case where ad-hoc withdrawals are made by Partners and Remuneration is decided at the end of the year as mentioned in Point (A) and Point (C) above, CBDT Circular or Notification clarifying the manner in which Firms and LLP can be compliant on such withdrawals would be beneficial.

Conclusion

The introduction of Section 194T marks a significant shift in tax treatment for partnership firms. Earlier the entire tax liability was in the hands of the partners, however from 1st April 2025, the Firm shall be liable to deduct TDS on such payments made to Partners.

While it aims to enhance tax compliance, it also imposes additional compliance burdens on firms and partners. To minimise tax implications and cash flow disruptions, firms will need to strategically plan partner withdrawals and maintain timely accounting records.

Authored by:

Virtue Jain | Direct Tax

FAQs

Section 194T requires TDS on payments made to partners of a partnership or LLP for their share of profits exceeding ₹50 lakh in a financial year.

TDS is 5% on the amount of profit paid to partners exceeding ₹50 lakh in a financial year.

The partnership firm or LLP making the payment to partners is responsible for deducting TDS.

Key provisions include applicability to profits over ₹50 lakh, 5% TDS rate, deposit of TDS with the government, and issuing TDS certificates to partners.

Partnerships must deduct TDS, file TDS returns, and reflect partner payments accurately, ensuring compliance and avoiding penalties.

Share

Share